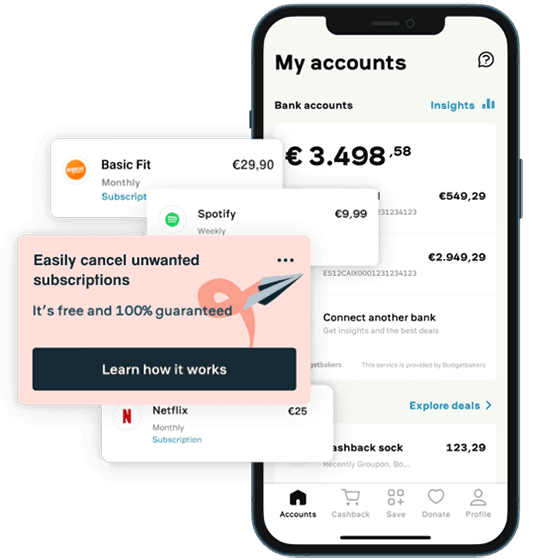

A rapid and intuitive connection

Connect customer accounts within minutes. Customise it all under your bespoke branding to make your customers feel safe and secure on every step of their journey.

Grow international

With Sniptech the door to international expansion is wide open. Instantly reach 5,000+ financial institutions across 20 countries and scale your business abroad.

Smart security for you and your clients

Our Open Banking API ensures your users’ personal data is protected to the highest EU standards. No more web scraping, get truly connected to your customers.

How it works

Connect customer accounts in three steps

01

Users select bank

Users select their bank from over 15,000 banks across 20 countries

02

Users authenticate

Users are redirected to their bank for authentication

03

Access data

Retrieve account, transaction and balance data in one place

Unlock the power of data

Wide coverage

Over 15,000 banks across 20 countries

Real-time overview

All transactional consumer data pseudonymized

Fully automated

Automated processing to enrich personalisation

PSD2 compliant

Connection through bank APIs

Simple integration

Friction-free developer experience with simple integration

Flexible

Customisable API that delivers a best-in-class service

Optimised merchant categorisation

Identify the exact merchant of every transaction and use data-powered insights to pinpoint marketing opportunities. Offer your customers enhanced financial insights with automated personalised reports.

Data-powered financial assessments

Improve your accuracy with data enrichment. Gain precise financial planning and spending insights that enable you to hit the mark every time. Take the guesswork out of loan and repayment potential with a tool that offers a 360° view of your customers’ financial position.

Plug and play integration

Start building your new revenue stream today with our ready-to-use data enrichment platform. Integration is fast and simple, while also offering a complete testing environment before going live.

How it works

Start categorising transactions in three steps

01

Connect to our API

Send the transactions to be categorised

02

Receive categorised transactions

Transactions now classified by category and merchant name

03

Display results in your ecosystem

Present categorised transactions your way

Unlock the power of data

Wide coverage

Over 15,000 banks across 20 countries

Real-time overview

All transactional consumer data pseudonymized

Fully automated

Automated processing to enrich personalisation

PSD2 compliant

Connection through bank APIs

Simple integration

Friction-free developer experience with simple integration

Flexible

Customisable API that delivers a best-in-class service